Project: Future orientation

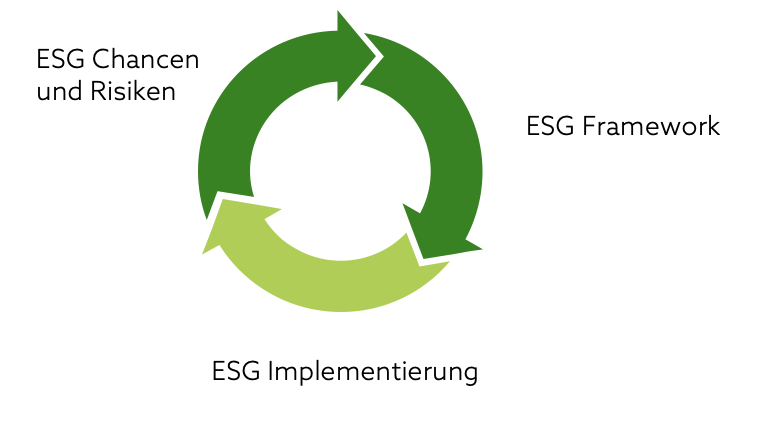

Strategic future orientation

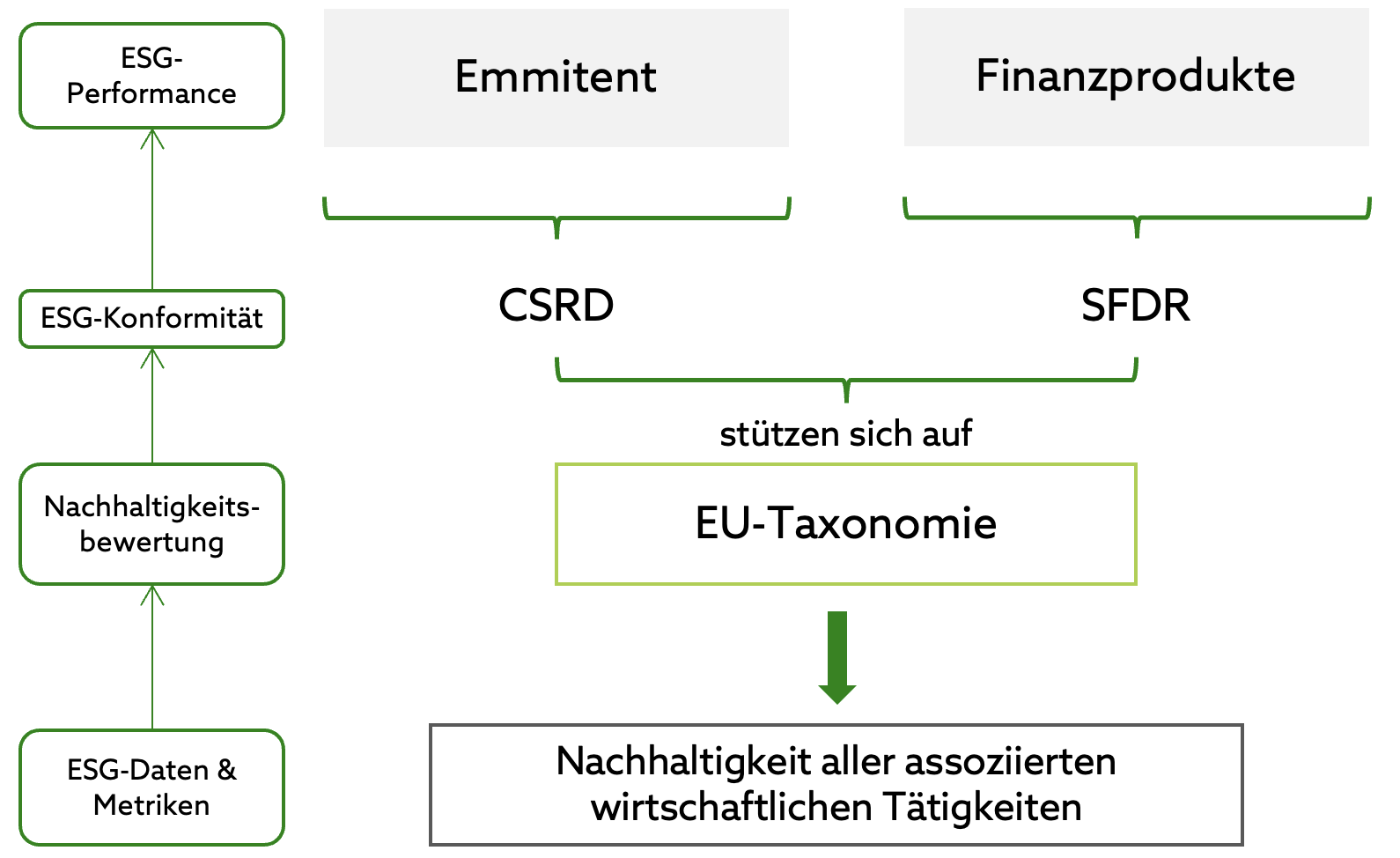

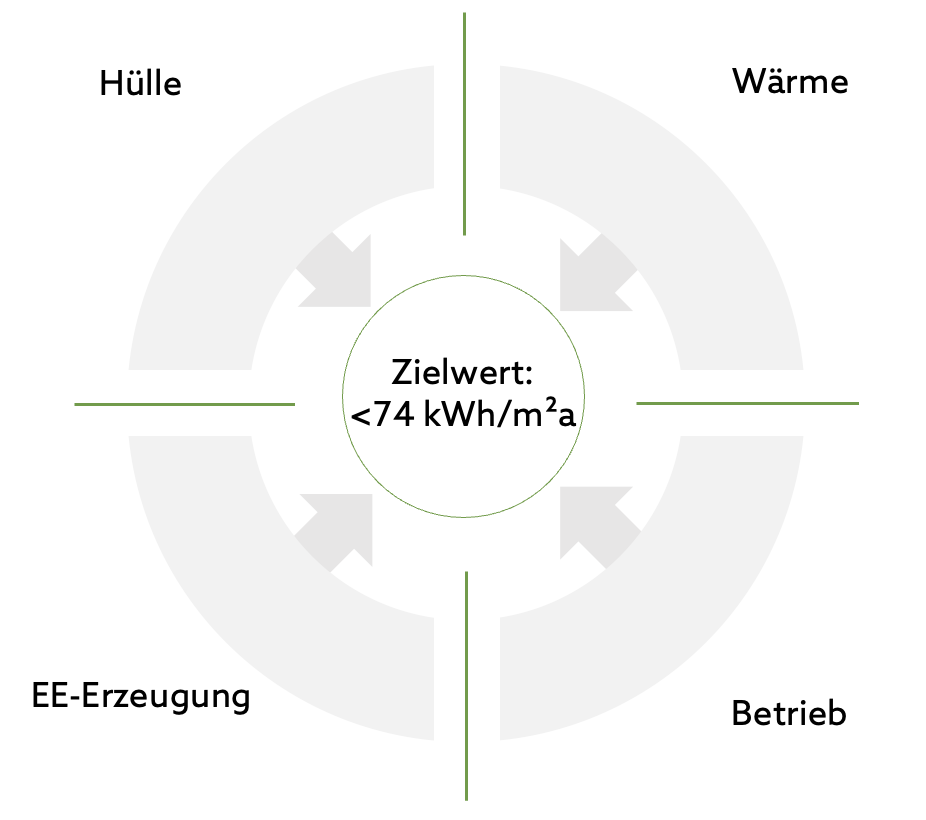

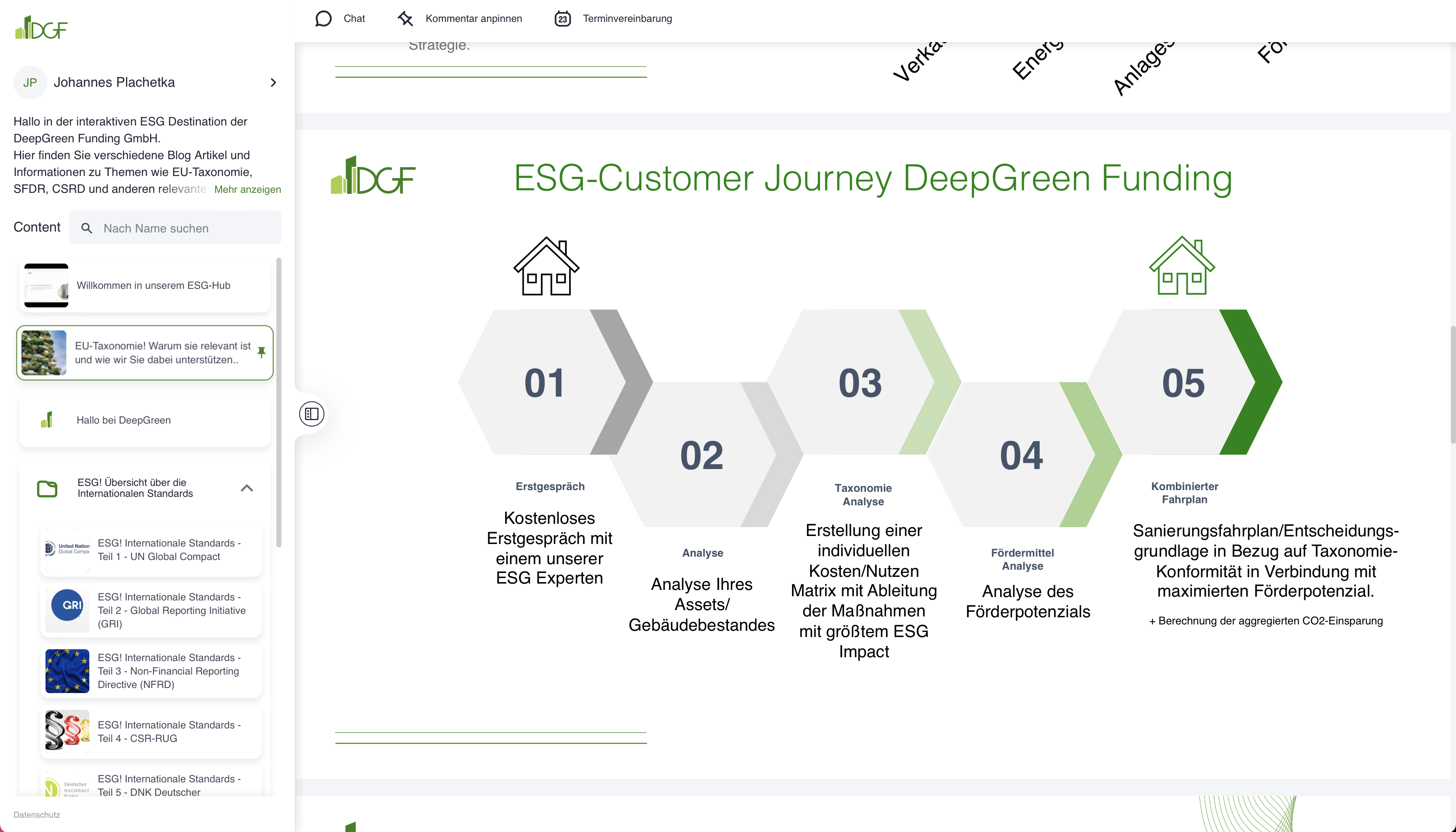

ESG consulting for a large German retail chain with focus on reporting requirements and certification of new construction & refurbishment.

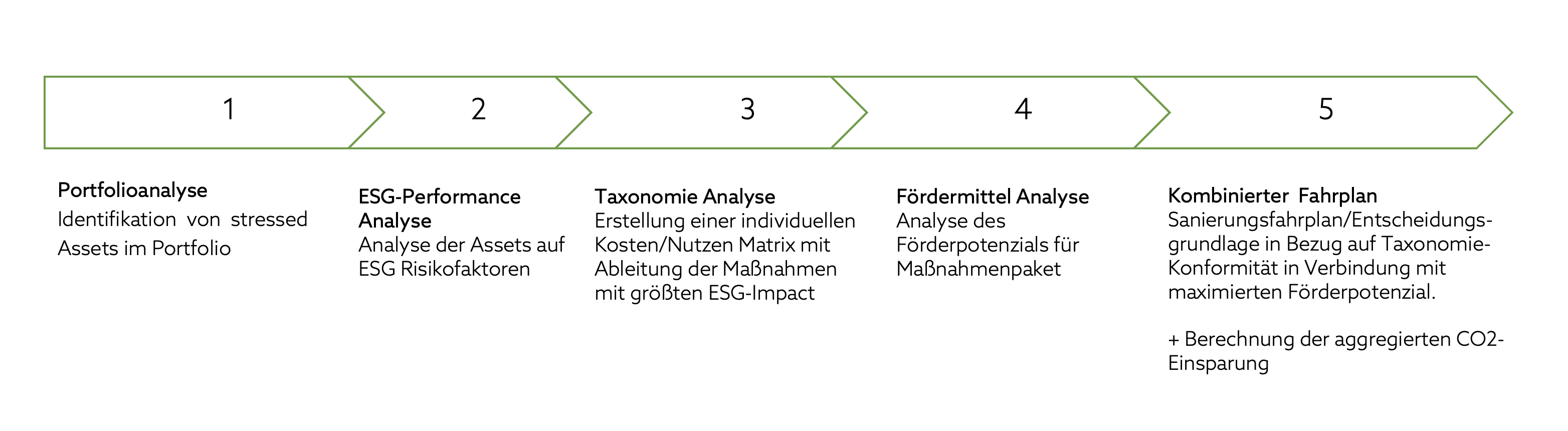

Value Proposition through DeepGreen:

- Full ESG consulting

Example of a project managed by DGF.

Your contact

- Johannes Plachetka, Head Of PM Munich

- [email protected]

- 089 2441784 86

- Schellingstraße 35, 80779 Munich

- Reporting

- Certification

- Future ESG compliance

- LEED, DGNB, BNB, etc.

- Align investment decisions to enable positive change for the world and reduce costs for sustainable actions.

Value added by DGF: